By Andrea Shalal

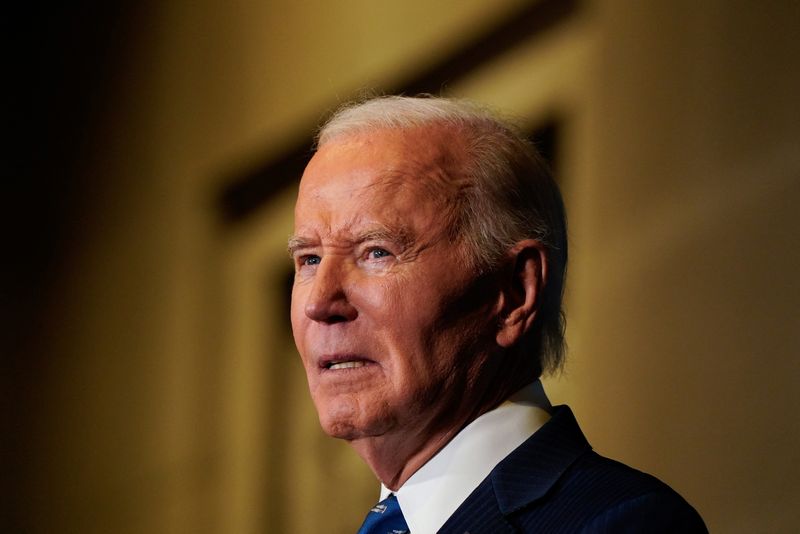

WASHINGTON (Reuters) – U.S. President Joe Biden will warn against further tax cuts for the wealthy and a reprise of Republican “trickle-down economics” during Donald Trump’s second term in what could be his final speech on the economy on Tuesday, a White House official said.

Biden will argue in the speech, which comes a month after bruising election defeats for the Democrats driven by voters’ concerns about inflation, that his push to boost investments in infrastructure, manufacturing and neglected communities averted a bigger economic crisis and laid the groundwork for continued economic growth, the official said.

Enacting another major tax cut benefiting rich Americans and cutting government old age and health insurance programs would threaten those gains, Biden will argue, while acknowledging that it will take years to see the full impact of his efforts.

In his remarks at the Brookings Institution, Biden plans to highlight the creation of 16 million jobs, the most in any single presidential term, the lowest average unemployment of any administration in 50 years and the smallest racial wealth gap in 20 years, the official said.

The speech echoes the message Biden pushed throughout his aborted 2024 election campaign and continued by Vice President Kamala Harris after he dropped out, although neither official was able to win over voters scarred by high food and housing prices.

Despite the strength of major economic indicators and a drop in inflation from a peak of 9% more than two years ago to 2.4%, voters punished the Democrats and handed the Republicans the White House and control of both the U.S. Senate and House of Representatives.

Investment banks expect Trump’s return to the White House to fuel a dealmaking revival that could boost investment banking income to $316 billion globally next year, a jump of about 5.7% on 2024, but economists warn that the Republican’s pledge to impose high tariffs could reignite inflation while further tax cuts could swell the already high U.S. deficit.