TAIPEI (Reuters) – Intel (NASDAQ:INTC) should have focused on artificial intelligence rather than trying to become a contract chipmaker, the founder of Taiwan Semiconductor Manufacturing Co said on Monday, in relation to the recent departure of Intel’s CEO.

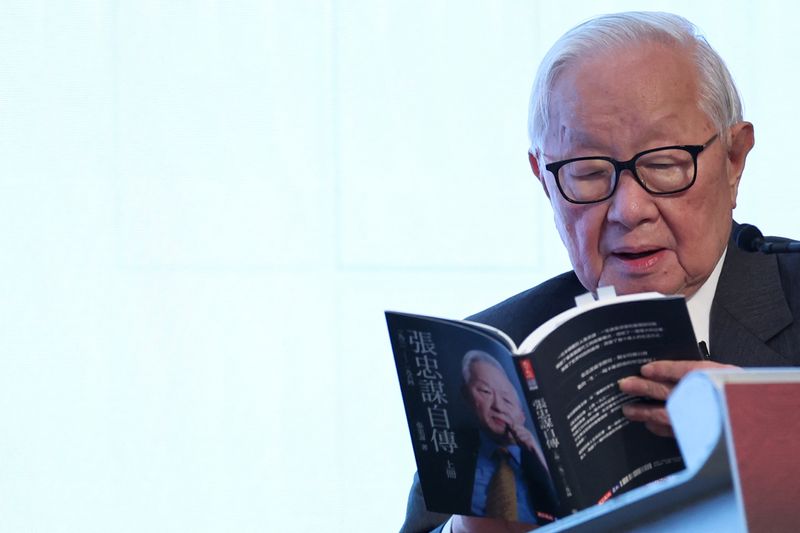

Morris Chang, at an event to launch his autobiography, said he did not know why Pat Gelsinger left Intel but that it seemed the U.S. firm sought a new strategy as well as a new CEO.

Gelsinger was forced out of Intel earlier this month after directors felt his costly and ambitious plan to turn Intel around was not working and progress was slow, Reuters reported last week.

Gelsinger was attempting to restore the company’s lead in making the fastest and smallest computer chips for other companies, a business model known as “foundry” – a crown it lost to TSMC – the world’s largest chip contract manufacturer.

“I don’t know why Pat resigned. I don’t know if his strategy was bad or if he didn’t execute it well…Compared with AI, he seemed to focus more on becoming a foundry. Of course now it seems that (Gelsinger) should have focused on AI,” Chang said.

“They currently have neither a new strategy nor a new CEO. Finding both is very difficult,” he added.

Intel did not immediately respond to a request for comment.

Setting lofty ambitions for manufacturing and AI capabilities among major clients, Intel lost or cancelled contracts under his watch and also offended TSMC, with Chang calling Gelsinger “a bit rude”, according to a Reuters special report in October.

Chang last month released his memoir that recounts his life from 1964 to 2018 and includes some of TSMC’s dealings with major customers such as Apple (NASDAQ:AAPL) and Qualcomm (NASDAQ:QCOM), and how Intel turned down an invitation to invest in TSMC in the 1980s before becoming a key customer.

(This story has been refiled to fix the company code in paragraph 1)